10 Day Trading Strategies for Beginners

Day trading is the act of buying and selling a financial instrument within the same day or even multiple times over the course of a day. Taking advantage of small price moves can be a lucrative game—if it is played correctly. But it can be a dangerous game for newbies or anyone who doesn't adhere to a well-thought-out strategy.

Not all brokers are suited for the high volume of trades made by day traders, however. But some brokers are designed with the day trader in mind. You can check out our list of the best brokers for day trading to see which brokers best accommodate those who would like to day trade.

The online brokers on our list, Fidelity and Interactive Brokers, have professional or advanced versions of their platforms that feature real-time streaming quotes, advanced charting tools, and the ability to enter and modify complex orders in quick succession.

Below, we'll take a look at some general day trading principles and then move on to deciding when to buy and sell, common day trading strategies, basic charts and patterns, and how to limit losses.

Day Trading Strategies

1. Knowledge Is Power

In addition to knowledge of basic trading procedures, day traders need to keep up on the latest stock market news and events that affect stocks—the Fed's interest rate plans, the economic outlook, etc.

So do your homework. Make a wish list of stocks you'd like to trade and keep yourself informed about the selected companies and general markets. Scan business news and visit reliable financial websites.

2. Set Aside Funds

Assess how much capital you're willing to risk on each trade. Many successful day traders risk less than 1% to 2% of their accounts per trade. If you have a $40,000 trading account and are willing to risk 0.5% of your capital on each trade, your maximum loss per trade is $200 (0.5% x $40,000).

Set aside a surplus amount of funds you can trade with and are prepared to lose. Remember, it may or may not happen.

3. Set Aside Time, Too

Day trading requires your time. That's why it's called day trading. You'll need to give up most of your day, in fact. Don’t consider it if you have limited time to spare.

The process requires a trader to track the markets and spot opportunities, which can arise at any time during trading hours. Moving quickly is key.

4. Start Small

As a beginner, focus on a maximum of one to two stocks during a session. Tracking and finding opportunities is easier with just a few stocks. Recently, it has become increasingly common to be able to trade fractional shares, so you can specify specific, smaller dollar amounts you wish to invest.

That means if Amazon shares are trading at $3,400, many brokers will now let you purchase a fractional share for an amount that can be as low as $25, or less than 1% of a full Amazon share.

5. Avoid Penny Stocks

You're probably looking for deals and low prices but stay away from penny stocks. These stocks are often illiquid, and chances of hitting a jackpot are often bleak.

Many stocks trading under $5 a share become delisted from major stock exchanges and are only tradable over-the-counter (OTC). Unless you see a real opportunity and have done your research, stay clear of these.

6. Time Those Trades

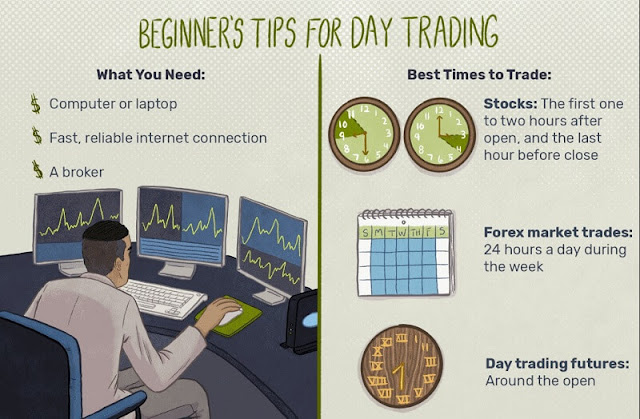

Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, which contributes to price volatility. A seasoned player may be able to recognize patterns and pick appropriately to make profits. But for newbies, it may be better just to read the market without making any moves for the first 15 to 20 minutes.

The middle hours are usually less volatile, and then movement begins to pick up again toward the closing bell. Though the rush hours offer opportunities, it’s safer for beginners to avoid them at first.

7. Cut Losses With Limit Orders

Decide what type of orders you'll use to enter and exit trades. Will you use market orders or limit orders? When you place a market order, it's executed at the best price available at the time—thus, no price guarantee.

A limit order, meanwhile, guarantees the price but not the execution. Limit orders help you trade with more precision, wherein you set your price (not unrealistic but executable) for buying as well as selling. More sophisticated and experienced day traders may employ the use of options strategies to hedge their positions as well.

8. Be Realistic About Profits

A strategy doesn't need to win all the time to be profitable. Many traders only win 50% to 60% of their trades. However, they make more on their winners than they lose on their losers. Make sure the risk on each trade is limited to a specific percentage of the account and that entry and exit methods are clearly defined and written down.

9. Stay Cool

There are times when the stock markets test your nerves. As a day trader, you need to learn to keep greed, hope, and fear at bay. Decisions should be governed by logic and not emotion.

10. Stick to the Plan

Successful traders have to move fast, but they don't have to think fast. Why? Because they've developed a trading strategy in advance, along with the discipline to stick to that strategy. It is important to follow your formula closely rather than try to chase profits. Don't let your emotions get the best of you and make you abandon your strategy. There's a mantra among day traders: "Plan your trade and trade your plan."

Before we go into some of the ins and outs of day trading, let's look at some of the reasons why day trading can be so difficult.

What Makes Day Trading Difficult?

Day trading takes a lot of practice and know-how, and there are several factors that can make the process challenging.

First, know that you're going up against professionals whose careers revolve around trading. These people have access to the best technology and connections in the industry, so even if they fail, they're set up to succeed in the end. If you jump on the bandwagon, it means more profits for them.

Uncle Sam will also want a cut of your profits, no matter how slim. Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. The one caveat is that your losses will offset any gains.1

As an individual investor, you may be prone to emotional and psychological biases. Professional traders are usually able to cut these out of their trading strategies, but when it's your own capital involved, it tends to be a different story.

Deciding What and When to Buy

Day traders try to make money by exploiting minute price movements in individual assets (stocks, currencies, futures, and options), usually leveraging large amounts of capital to do so. In deciding what to focus on—in a stock, say—a typical day trader looks for three things:

Liquidity allows you to enter and exit a stock at a good price—for instance, tight spreads, or the difference between the bid and ask price of a stock, and low slippage, or the difference between the expected price of a trade and the actual price.

Volatility is simply a measure of the expected daily price range—the range in which a day trader operates. More volatility means greater profit or loss.

Trading volume is a measure of how many times a stock is bought and sold in a given time period—most commonly known as the average daily trading volume. A high degree of volume indicates a lot of interest in a stock. An increase in a stock's volume is often a harbinger of a price jump, either up or down.

When you know what kind of stocks (or other assets) you're looking for, you need to learn how to identify entry points—that is, at what precise moment you're going to invest. Tools that can help you do this include:

Real-time news services: News moves stocks, so it's important to subscribe to services that tell you when potentially market-moving news breaks.

ECN/Level 2 quotes: ECNs, or electronic communication networks, are computer-based systems that display the best available bid and ask quotes from multiple market participants and then automatically match and execute orders. Level 2 is a subscription-based service that provides real-time access to the Nasdaq order book composed of price quotes from market makers registering every Nasdaq-listed and OTC Bulletin Board security. Together, they can give you a sense of orders executed in real time.

Intraday candlestick charts: Candlesticks provide a raw analysis of price action. More on these later.

Define and write down the conditions under which you'll enter a position. "Buy during uptrend" isn't specific enough. Something like this is much more specific and also testable: "Buy when price breaks above the upper trendline of a triangle pattern, wherein the triangle was preceded by an uptrend (at least one higher swing high and higher swing low before the triangle formed) on the two-minute chart in the first two hours of the trading day."

When you have a specific set of entry rules, scan through more charts to see if those conditions are generated each day (assuming you want to day trade every day) and more often than not produce a price move in the anticipated direction. If so, you have a potential entry point for a strategy. You'll then need to assess how to exit, or sell, those trades.